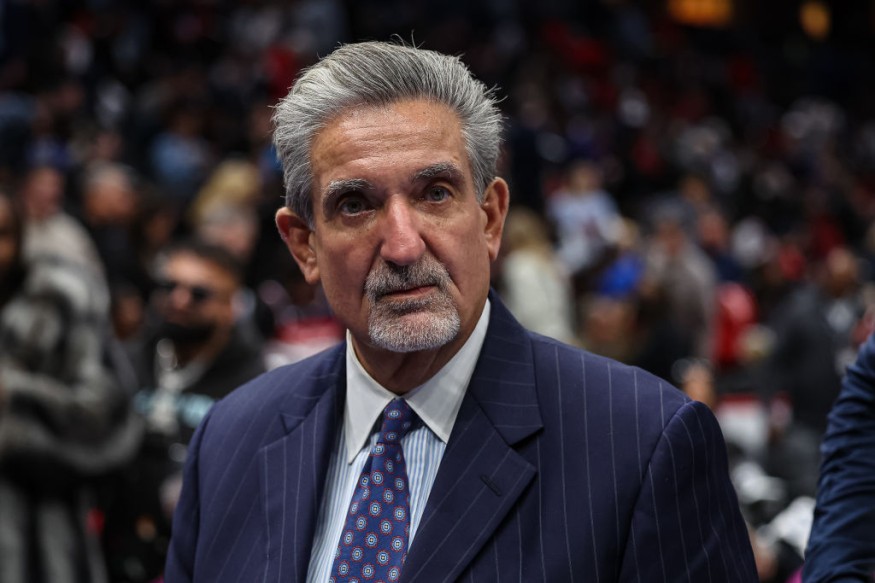

Businessman and investor Ted Leonsis believes that an increasing number of sovereign wealth funds will continue to add sports investments in their portfolios.

Leonsis' company Monumental Sports & Entertainment holds ownership of the NBA's Washington Wizards, NHL's Washington Capitals, and WNBA's Washington Mystics.

Earlier this year, the Capitals and Wizards became the first teams from United States' big four leagues to accept sovereign wealth fund investments.

Qatar Investment Authority acquired a 5 percent stake in Monumental Sports & Entertainment for $200 million last June.

"You'll see. I believe other teams and other leagues will all be embracing pension funds, college endowments, university endowments and sovereign wealth funds as investors, as a part of the tapestry of their investment base," the 66-year-old executive said.

However, NBA Commissioner Adam Silver clarified that there is no foreseeable pathway for sovereign wealth funds to become the controlling owners of an NBA franchise at present.

This limitation arises from the requirement for a controlling owner of an NBA team to hold a minimum ownership share of 15% of the franchise, while any involvement from a sovereign wealth fund is restricted to a passive investment not exceeding 5% in a team.

Read more: Los Angeles Lakers Star LeBron James Sounds Off On Missed Calls In Narrow Loss vs Miami Heat

Sports teams controlled by sovereign wealth funds

Several prominent sports teams are under the ownership or control of sovereign wealth funds, which provide a huge financial boost and a competitive edge against other teams.

Manchester City

The first big-profile acquisition of a sports team by a sovereign wealth fund happened in September 2008, when Abu Dhabi United Group, an investment and development company owned by the Abu Dhabi royal family, took over Premier League club Manchester City.

Previously a team with a lackluster history, Manchester City underwent a radical transformation with the infusion of substantial financial resources. The club made several high-profile signings and secured their first Premier League title in 44 years in 2012.

By 2023, they had established themselves as one of the most dominant teams in the history of the sport, achieving only the eighth continental treble in Europe.

Paris Saint-Germain

Qatar Sports Investments, the same sovereign wealth fund that invested in the Washington sports teams, bought a 70 percent stake at French club Paris Saint-Germain in June 2011.

A few months later, they became the sole shareholder of the team, buying out the remaining 30 percent stake in March 2012.

Since then, PSG has dominated domestic competition, winning nine of their 11 Ligue 1 titles since the Qataris took over.

Furthermore, the club has made significant splashes in the transfer market with several high-profile signings, setting the world transfer fee record for the acquisition of Brazilian star Neymar.

Additionally, their transfer for French sensation Kylian Mbappe ranks as the second most expensive in football history.

Newcastle United

The latest among sovereign wealth funds taking over major sports teams, a consortium led by Saudi Arabia's Public Investment Fund acquired the Premier League club in October 2021 for around $370 million.

After narrowly avoiding relegation during the 2021-22 season, the club made a sensational turnaround in the 2022-23 season by finishing fourth in the league and qualifying for the UEFA Champions League for the first time in 20 years.

Related Article: 23-24 Season

© Copyright 2025 Sports World News, All rights reserved. Do not reproduce without permission.